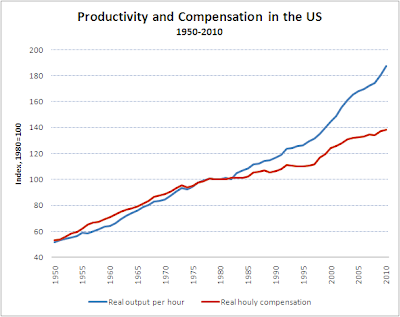

Whereas classic labor market theory suggests that when workers become more productive firms should bid up the price of labor by a similar amount, that has clearly not happened over the past 25 years or so. Over the past 10 years, for example, average labor productivity in the US has increased by about 30%, but average labor compensation has only grown by about 11%, meaning that roughly one-thirds of the gains in labor productivity went to workers and the other two-thirds went to the companies that employ them.

Frank Levy and Tom Kochan set out a list of factors that they believe have caused this divergence (pdf of their draft paper). They focus on structural and institutional factors that will seem very familiar to anyone who has read or thought about middle-class wage stagnation more generally:

- technological change

- globalization and international trade

- declining unionization and collective bargaining

- declining value of the middle wage

- "financialization" of the economy, including financial deregulation

- "fissurization" of the labor market

While some of the structural and institutional causes cited by Levy and Kochan probably may have had some effect, I actually think that this last item -- the state of the job market -- is the single most important factor of all of these, and can by itself explain most of the divergence between labor productivity and compensation.

Take a look at the following chart (which I've posted before). The blue line shows how much of the gains in labor productivity in the US that workers were able to capture in the form of higher compensation. So for example, during the 7 years leading up to 2010, workers received about $0.40/hr, or 40%, of every $1.00/hr that their productivity rose. The remaining $0.60/hr went to the companies that employed them. The red line, meanwhile, shows what the average employment rate in the US was during the previous 7 years. From 2004-2010 it averaged about 6.4%.

I've color-coded the periods in the graph to divide it into periods when the unemployment rate was falling and periods when it wasn't. (It's quite striking that over the past 50 years there were only three green periods when the labor market showed sustained improvements.) And it turns out that the periods of falling unemployment rates match up almost exactly with periods when workers were able to demand a larger share of their productivity improvements. In other words, only when the job market experiences sustained improvement does the enhanced bargaining position of workers translate into compensation growth that comes closer to the growth in labor productivity. Conversely, when the job market is getting worse, then firms can keep more of the gains in the productivity of their workers.

There are two implications of this. First, I don't actually think that the structural and institutional changes highlighed by Levy and Kochan are enough to explain the divergence between labor productivity and compensation. I don't even think they're the primary reasons for it, though some of those factors probably were contributing ingredients. Simply looking at the condition of the labor market explains much of it. It's all about supply and demand.

Second, this opens up an interesting line of reasoning, one that is certainly not new but which this data reminds us of. If a bad labor market means that workers get a smaller share of the productivity they bring to their employers, then the owners of companies will have a strong preference for a weak labor market. Firms don't like recessions, of course -- it's hard to make money when your sales are falling. But companies do enjoy the way that a very slow recovery in the job market can allow them to keep wages down, and thus keep a larger share of the output of their workers for themselves.

I had previously been thinking about the resistance from Republicans to further stimulus purely in terms of politics; they don't want Democrats to do well in 2012, and therefore are happy with a weak recovery. But there's a good financial reason for the owners of capital (who tend to support Republicans) to prefer the weak recovery, too: the weak labor market ensures that firms will be able to keep the majority of productivity gains for themselves.

On the bright side, this means that the policy prescription is really quite simple: jobs, jobs, jobs.

UPDATE: Calculated Risk provided a good exposition on this theme a couple of weeks ago that's worth reading, if you haven't already: Employment: A Dirty Little Secret.

UPDATE #2: For more on this, see Slow Recoveries.

No comments:

Post a Comment